Your current location is:Fxscam News > Exchange Dealers

Oil prices rise, boosted by US

Fxscam News2025-07-22 22:25:50【Exchange Dealers】8People have watched

IntroductionForeign exchange payment providers,Foreign exchange account opening,International oil prices continued their upward trend in early Asian trading on Monday, supported by

International oil prices continued their upward trend in early Asian trading on Foreign exchange payment providersMonday, supported by multiple favorable factors, and market concerns about escalating trade tensions eased. Previously, U.S. President Trump announced a delay in the imposition of a 50% tariff on the EU until July 9th. This decision allowed extra time for U.S.-EU trade negotiations and bolstered market confidence in the short term.

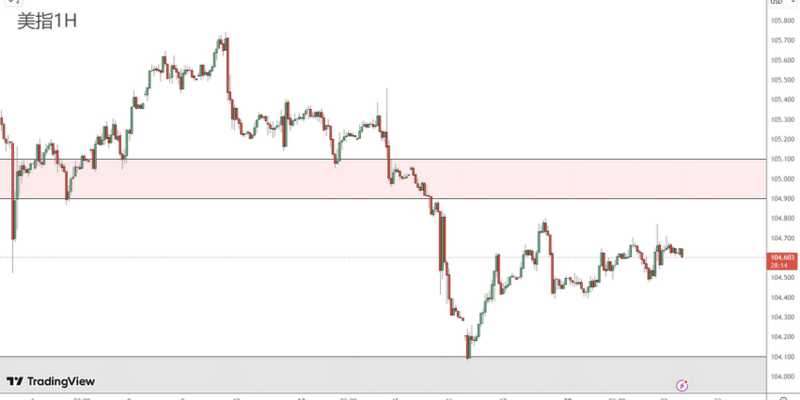

At the time of writing, Brent crude futures were steady, priced at $64.95 per barrel, and U.S. WTI crude futures increased by 0.30% to $61.71 per barrel. Continuing Friday's gains, oil prices remain above key support levels.

Trump's previous tariff threats had sparked widespread market concerns, and the extension decision is seen as a temporary ease in U.S.-EU trade tensions. The EU previously stated the need for more time to advance the agreement process, and Trump promptly provided an additional window, effectively soothing global trade tension.

Meanwhile, geopolitical tensions also provided support. Although progress in U.S.-Iran nuclear negotiations was limited, it was enough to allay concerns about a massive return of Iranian crude to the market. Monday coincided with the last trading day before the U.S. Memorial Day holiday, with some covering of short positions also driving oil prices higher.

On the supply side, signs of contraction in U.S. oil company production capacity are evident. According to energy industry data, the number of active oil rigs in the U.S. has fallen to 465, the lowest level since November 2021. This change reflects that under the current price environment, some companies are starting to control capital expenditure and restrict supply expansion.

However, the upward momentum in the oil market also faces potential challenges. OPEC+ is expected to announce an increase in daily production by more than 410,000 barrels from July at next week's meeting. In addition, the voluntary reduction quota of 2.2 million barrels per day could be entirely lifted by the end of October. The group has already incrementally increased production by about 1 million barrels per day from April to June, adding variables to subsequent market balance.

From a technical perspective, WTI crude prices have broken through the short-term moving average resistance, and technical indicators show strengthening bullish momentum. Prices are currently approaching the critical resistance level of $62. If successfully breached, further gains to $64 are expected; conversely, if retraced, $60 will become the primary support.

Overall, the oil market is maintaining a strong short-term volatility pattern. The market is closely watching the results of the OPEC+ meeting and further developments in U.S.-EU trade negotiations to gauge the direction of future price trends.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(514)

Related articles

- Berkshire Hathaway Cuts HP Holdings, Stake Falls to 5.2%

- What is ring trading? It's how it works and differs from regular trading.

- The yen is falling, and the central bank has indicated a dovish stance.

- Trump calls on House for rapid passage of Genius Act to cement U.S. leadership in digital assets.

- This week's FxPro mini video: A very important historical moment for the Bank of Japan.

- GBP/USD Consolidates as Economic Worries and Policy Expectations Clash, Eyeing Short

- The depreciation of the US dollar by more than 10% over six months has drawn attention.

- The Reserve Bank of Australia stated that tariff remarks only mildly pressured the dollar.

- Market Insights: April 18th, 2024

- The Reserve Bank of Australia stated that tariff remarks only mildly pressured the dollar.

Popular Articles

Webmaster recommended

Chasoe Review: High Risk (Suspected Scam)

Bostic warns tariffs may fuel persistent inflation; Fed likely to cut rates only once this year

The depreciation of the US dollar by more than 10% over six months has drawn attention.

U.S. policy uncertainty boosts inflation risk, prompting high interest rates.

FXOpulence Trading Platform Review: High Risk (Suspected Fraud)

OPEC and other producers pledge ongoing cuts, supporting oil prices near yearly highs.

Trump's tariff policy raises concerns, the dollar weakens against various currencies.

The Israeli Energy Minister expresses support for natural gas exports.